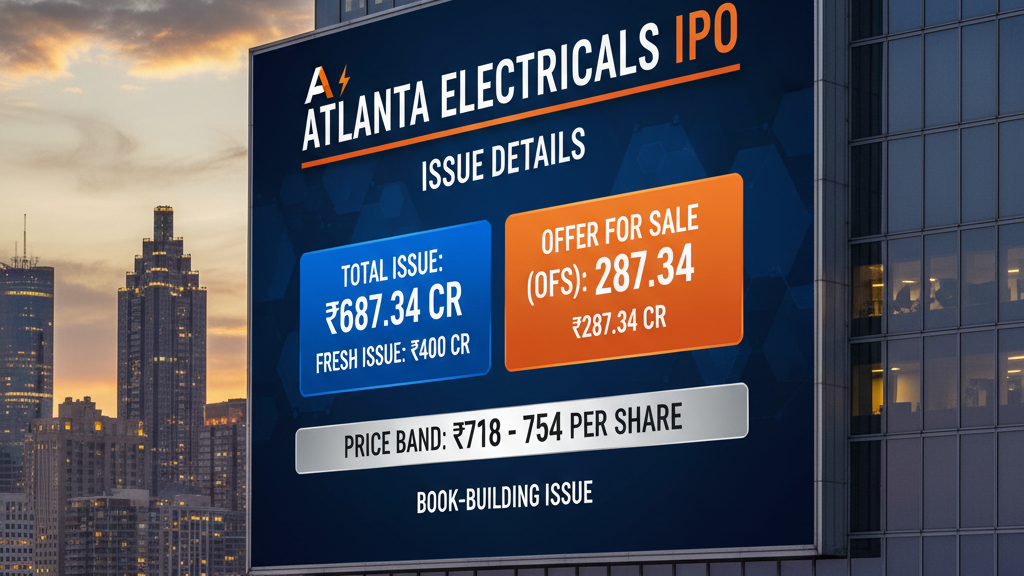

The Indian primary market is buzzing with activity as Atlanta Electricals prepares to launch its initial public offering (IPO). This much-anticipated book-building issue aims to raise a substantial ₹687.34 crore, attracting significant attention from both institutional and retail investors. If you’re considering participating in this IPO, here’s a comprehensive breakdown of the key details, what to expect, and why it’s making headlines.

Understanding the Atlanta Electricals IPO Structure

The Atlanta Electricals IPO is structured as a book-building issue with a total size of ₹687.34 crore. This figure is bifurcated into two main components:

- Fresh Issue of ₹400 Crore: This portion of the IPO involves the company issuing new shares to the public. The proceeds from this fresh issue will directly flow into Atlanta Electricals, typically used for purposes such as funding capital expenditure, debt reduction, working capital requirements, or general corporate purposes, thereby strengthening the company’s balance sheet and growth prospects.

- Offer for Sale (OFS) of ₹287.34 Crore: In the OFS component, existing shareholders, promoters, or early investors sell a portion of their holdings to the public. The funds generated from the OFS go to these selling shareholders, not to the company itself. This allows early investors to monetize their investments and can also help meet regulatory requirements for minimum public shareholding.

Key Details at a Glance

- Total Issue Size: ₹687.34 crore

- Fresh Issue: ₹400 crore

- Offer for Sale (OFS): ₹287.34 crore

- Price Band: ₹718 to ₹754 per share

- Issue Type: Book-Building Issue

What is a Book-Building Issue?

A book-building IPO allows the issuer to discover the optimal price for its shares based on demand from investors. Within the specified price band (₹718 to ₹754 per share for Atlanta Electricals), investors can bid for shares. The final offer price, known as the cut-off price, is determined after the bidding process concludes, usually at a price that generates sufficient demand to cover the entire issue. This method ensures fair price discovery and broad participation.

Why is Atlanta Electricals IPO Generating Interest?

Atlanta Electricals operates in a crucial sector, and its IPO signifies a growth phase for the company. Factors such as the company’s financial performance, market positioning, growth strategies, and the overall outlook for the electrical sector will play a significant role in investor sentiment.

Grey Market Premium (GMP) – A Quick Note

As of 23 September 2025, Atlanta Electricals PO’s GMP stood at ₹110. The estimated listing price is ₹864, i.e., a 14.59% gain per share over the upper price band.