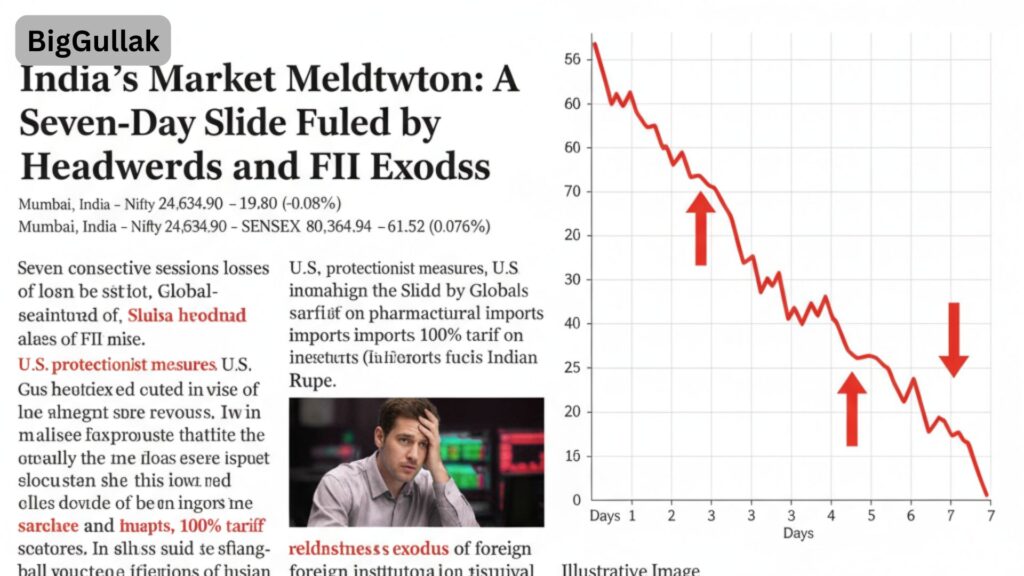

India’s benchmark indices, the Nifty and Sensex, have endured their seventh consecutive session of losses, marking the longest losing streak since March 2025. This relentless market meltdown has seen the Nifty close at 24,634.90, down 0.08%, while the Sensex ended at 80,364.94, shedding 0.076%. The sustained downturn is a stark reminder of the interconnectedness of global economies and the significant influence of foreign policy on domestic markets.

The primary catalyst for this prolonged sell-off has been a series of protectionist measures enacted by the United States. New policies, including a substantial increase in H-1B visa application fees and a daunting 100% tariff on pharmaceutical imports, have sent shockwaves through India’s export-oriented IT and pharmaceutical sectors. These measures, perceived as a direct threat to the profitability and growth prospects of these crucial industries, have triggered widespread panic selling.

Adding fuel to the fire has been the relentless exodus of foreign institutional investors (FIIs). Their sustained and aggressive selling across various sectors has exacerbated the market’s decline, creating a self-reinforcing cycle of negativity. The weakening Indian Rupee, which has been flirting with all-time lows against the U.S. dollar, further compounds the problem, making Indian assets less attractive to foreign investors and increasing import costs.

From a technical perspective, the Nifty has breached several key moving averages, a development often interpreted by market analysts as a strong bearish signal. This technical breakdown reinforces the prevailing sentiment of caution and uncertainty among traders.

While domestic news such as the government’s clarity on pricing reforms for the energy sector has offered some sporadic positives, these have been largely overshadowed by the dominant negative forces emanating from the global arena. The energy sector, for instance, has shown some resilience, but its gains have been insufficient to stem the broader market’s decline.

The market’s immediate future now hinges significantly on domestic developments, with all eyes on the upcoming Reserve Bank of India (RBI) policy decision. Investors will be scrutinizing the RBI’s stance on interest rates, inflation, and economic growth projections for any clues that could provide a much-needed shot in the arm for the beleaguered indices.

As the Indian market grapples with this prolonged period of volatility, the current scenario underscores the importance of a diversified investment strategy and a keen awareness of global macroeconomic shifts. The path to recovery will likely be contingent on a de-escalation of trade tensions and a renewed influx of foreign capital, both of which appear distant prospects for now.