The Indian stock market’s recent slide continued for a sixth straight session today, driven by a wide-ranging sell-off. The key factors behind the decline are new U.S. tariffs on pharmaceuticals and persistent concerns over demand in the IT sector.

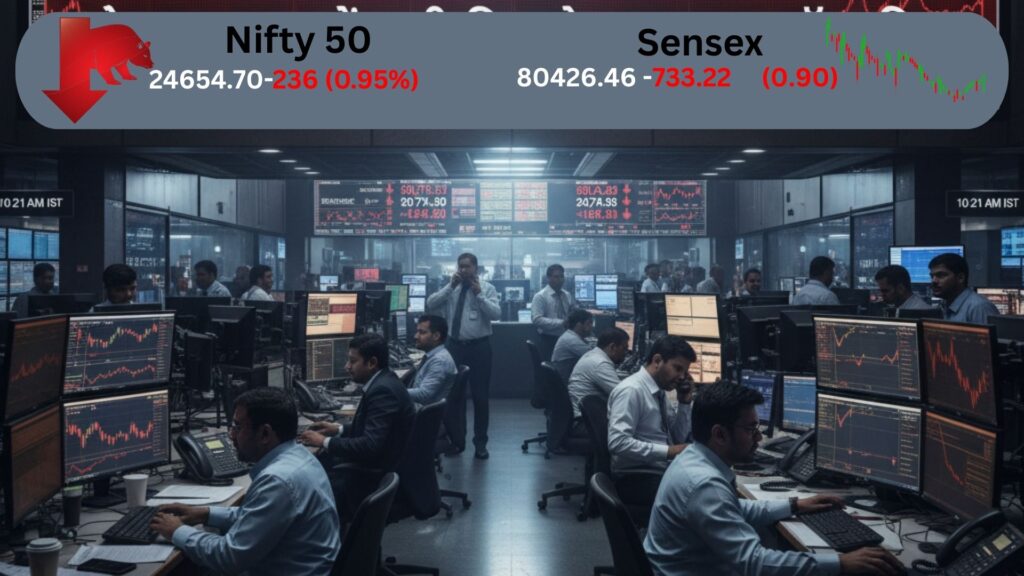

Current Market Snapshot

- Benchmark Indices: Both the Sensex and Nifty 50 opened lower and stayed in the red throughout the Day. The Sensex was down about 761 points (0.94%) to 80,394.23, while the Nifty 50 was trading at 24,647.3, a drop of 243 points (0.98%).

- Broader Market: The weakness wasn’t limited to the top stocks, with mid-cap and small-cap indices falling by 0.8% and 1.2%, respectively. All Nifty sectoral indices were in the red, showing broad pressure.

Key Drivers of the Downturn

- U.S. Pharma Tariffs: A major trigger was the U.S. President’s announcement of a 100% tariff on branded and patented drugs, effective October 1. This has created significant uncertainty for India’s pharmaceutical exports, as the U.S. is a critical market, accounting for over a third of India’s pharma exports.

- IT Sector Challenges: The IT sector is also under pressure. Accenture’s recent weak revenue outlook, coupled with uncertainties over new U.S. H-1B visa policies, has raised concerns about a slowdown in demand. The IT index has already dropped 5.5% in the last four sessions.

- Other Factors: The market is also being weighed down by continued selling by foreign institutional investors (FIIs), profit booking, and mixed global signals.

Sectoral Performance

- The pharma and healthcare sectors were the hardest hit, with the pharma index declining by 2.1%. Key stocks like Sun Pharmaceutical Industries hit a 52-week low.

- The IT index was down 2.2%, with major players like TCS seeing losses.

- Other sectors like auto, power, and realty also saw declines. The metals sector was one of the few exceptions, seeing a slight gain.

This broad-based selling suggests investors are taking a cautious approach as they navigate the current geopolitical and economic uncertainties.